Buying a home for the first time is an exciting adventure, but it can also be a daunting process. Here, we'll walk you through the steps of purchasing your first home in Fort Lauderdale, one of Florida's most vibrant cities.

Why Fort Lauderdale?

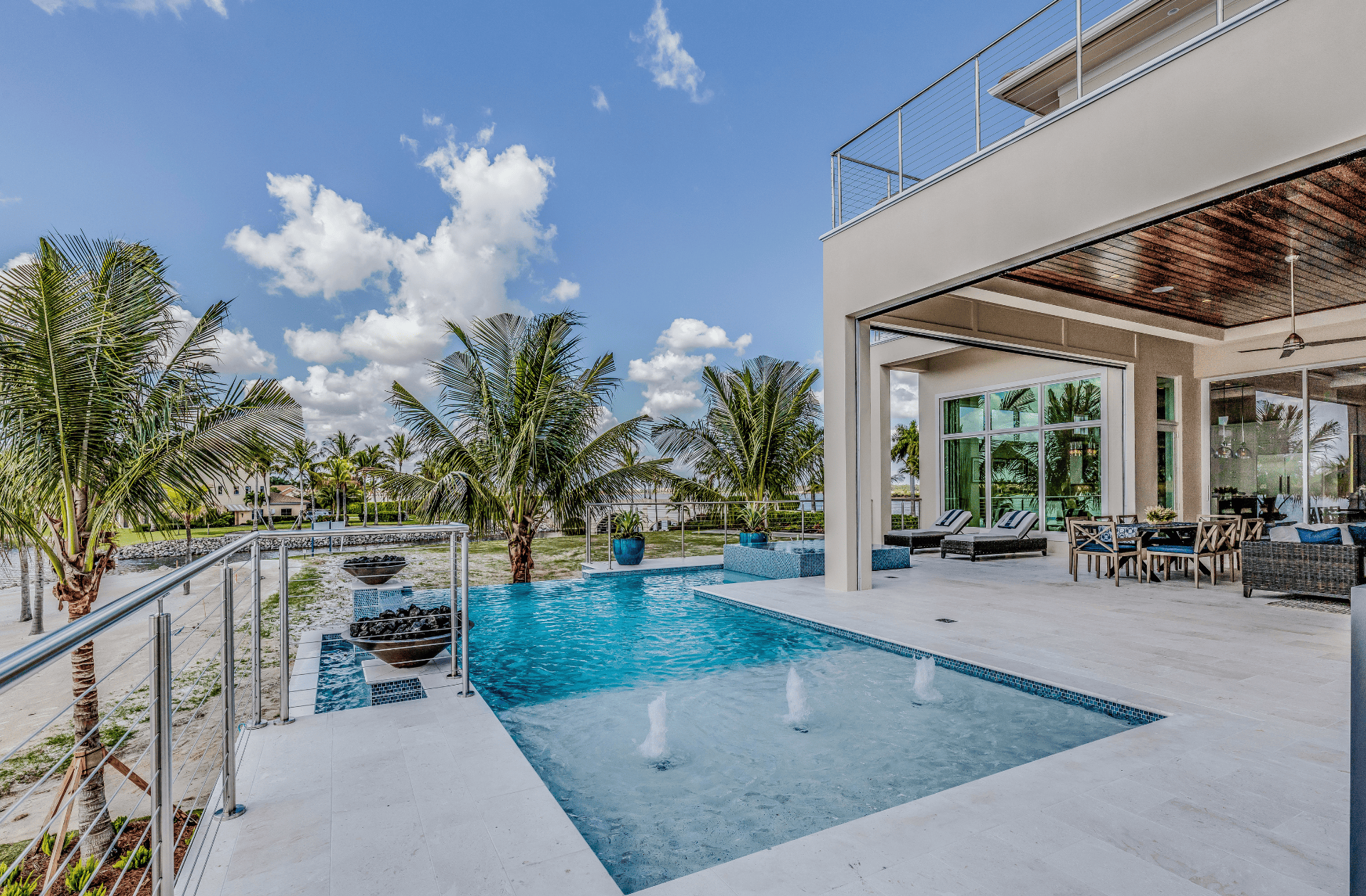

Fort Lauderdale boasts a rich cultural heritage, picturesque waterways, and a booming real estate market. It's a city that offers a quality lifestyle, making it an ideal place to invest in your first home.

Understanding Your Budget

Before you embark on your home-buying journey, it's essential to assess your financial health. This involves reviewing your savings, understanding your monthly expenses, and knowing how much mortgage you can afford.

Knowing the Local Real Estate Market

Understanding the Fort Lauderdale real estate market is crucial. Research the current trends, the average house prices, and the factors affecting these prices.

Importance of Preapproval for Mortgage

Getting pre-approved for a mortgage gives you an estimate of how much you can borrow, making it easier to shop for homes within your budget.

Choosing the Right Neighborhood

Fort Lauderdale has numerous neighborhoods each with its unique charm. Consider your lifestyle, proximity to work, schools, and amenities when choosing a neighborhood.

Working with a Realtor

Working with a realtor can help ease the home buying process. They can guide you in choosing the right neighborhood, making offers, and negotiating the best deal.

Understanding the Types of Homes

There are various types of homes available in Fort Lauderdale, including condos, apartments, single-family homes, and townhouses. Each has its pros and cons, and understanding these can help you make an informed decision.

Making an Offer

Once you've found a home you love, it's time to make an offer. Your realtor can guide you in negotiating the price and including contingencies in your offer.

Home Inspection

A home inspection is a crucial part of the home-buying process. It helps you understand the condition of the house and can influence your decision to proceed with the purchase.

The Closing Process

Closing is the final step in buying a home. Be prepared for closing costs, which can include lender fees, title fees, and more.

Living in Fort Lauderdale

Living in Fort Lauderdale offers a vibrant lifestyle, with numerous recreational activities, dining options, and cultural attractions.

Conclusion

Buying your first home in Fort Lauderdale can be a thrilling experience. With careful planning, financial preparation, and the right realtor, you can find a home that suits your lifestyle and budget.

Frequently Asked Questions

Q. What is the average price of a home in Fort Lauderdale?

A. As of mid-2023, the average home price in Fort Lauderdale varies depending on the neighborhood, type of home, and current market conditions. However, the median home price is generally around $400,000. Remember, prices can fluctuate and it's always best to check current listings or consult with a realtor for the most accurate information.

Q. What are the best neighborhoods for first-time homebuyers in Fort Lauderdale?

A. Several neighborhoods in Fort Lauderdale are well-suited for first-time homebuyers. Victoria Park is known for its variety of homes and close proximity to downtown. Poinsettia Heights is popular for its affordability and central location. Wilton Manors is loved for its vibrant lifestyle and diverse community. Always choose a neighborhood that fits your lifestyle, budget, and needs.

Q. How long does the home buying process take in Fort Lauderdale?

A. The home buying process can vary significantly from one purchase to another, but typically, it can take between 30-60 days from the time your offer is accepted until the closing day. This timeline can be influenced by various factors including your mortgage approval process, negotiations, home inspections, and any unexpected issues that arise.

Q. What should I look for during a home inspection?

A. During a home inspection, look for any signs of structural damage, such as cracks in the walls or uneven floors. Check the condition of the roof, the HVAC system, electrical wiring, plumbing, and insulation. Also, pay attention to potential issues like water damage, mold, or pest infestations. A professional home inspector can provide a detailed report about the home's condition.

Q. What are the typical closing costs when buying a home in Fort Lauderdale?

A. In Fort Lauderdale, closing costs typically range from 2% to 5% of the purchase price. These costs can include a variety of fees such as loan origination fees, appraisal fees, title searches, title insurance, surveys, taxes, and credit report charges. Your lender should provide a detailed breakdown of these costs in the 'Loan Estimate' and the 'Closing Disclosure' forms.

Leave A Comment