Introduction

When it comes to purchasing a home in Fort Lauderdale, one of the essential steps in the home buying process is getting pre-approved for a home loan. Fort Lauderdale, located in sunny South Florida, is a highly sought-after real estate market with a diverse range of properties.

Whether you're a first-time homebuyer or an experienced investor, getting pre-approved can significantly enhance your home buying experience.

In this article, we'll delve into the importance of pre-approval, the process involved, and how it can give you an advantage in Fort Lauderdale's competitive real estate market.

Understanding Pre-Approval for a Home Loan:

Before we delve into the process, let's understand what pre-approval means. Pre-approval is a preliminary evaluation by a lender to determine how much they are willing to lend you based on your financial situation. It's essential to note that pre-approval is not the same as pre-qualification. Pre-qualification is a more informal assessment that gives you an estimate of how much you may be eligible to borrow. Pre-approval, on the other hand, involves a comprehensive review of your financial documents, making it a more reliable indicator of your borrowing capacity.

The Pre-Approval Process:

Getting pre-approved for a home loan involves several steps. The first step is to gather all the necessary documents, including bank statements, tax returns, pay stubs, and identification. Once you have these documents ready, you can start shopping for a lender. It's essential to choose a lender that suits your needs and offers favorable terms.

Next, you'll need to submit a formal loan application. The lender will perform a credit check and verify the information provided in your application. Upon successful verification, you'll receive a pre-approval letter, which states the maximum loan amount you qualify for.

Advantages of Getting Pre-Approved:

Obtaining pre-approval for a home loan can provide several advantages, particularly in a competitive market like Fort Lauderdale. Firstly, pre-approval gives you stronger negotiating power. Sellers are more likely to consider your offer seriously if they know you have already been pre-approved. Additionally, pre-approval provides you with a clear budget, helping you focus on properties within your price range.

Moreover, the homebuying process becomes faster and smoother with pre-approval. Since much of the paperwork and verification are already completed, the final loan approval process is more efficient. In a hot real estate market like Fort Lauderdale, a pre-approval can give you a competitive edge over other buyers.

Factors Affecting Pre-Approval Eligibility:

Several factors can influence your pre-approval eligibility. One of the most critical factors is your credit score and credit history. Lenders prefer borrowers with a good credit score as it demonstrates their ability to manage debt responsibly. Additionally, your debt-to-income ratio, which compares your monthly debt obligations to your income, is another crucial factor in the pre-approval process.

Furthermore, lenders consider your employment and income stability. A steady job history and a reliable source of income can boost your pre-approval chances.

Tips to Improve Pre-Approval Chances:

If you want to increase your likelihood of getting pre-approved for a home loan, there are several steps you can take. Start by checking your credit reports for any errors and correcting them promptly. Paying off existing debts and reducing financial obligations can also positively impact your pre-approval prospects.

During the pre-approval process, avoid making significant financial changes, such as taking on new debt or making large purchases. Lenders prefer stability and consistency in your financial situation.

Navigating Fort Lauderdale's Real Estate Market:

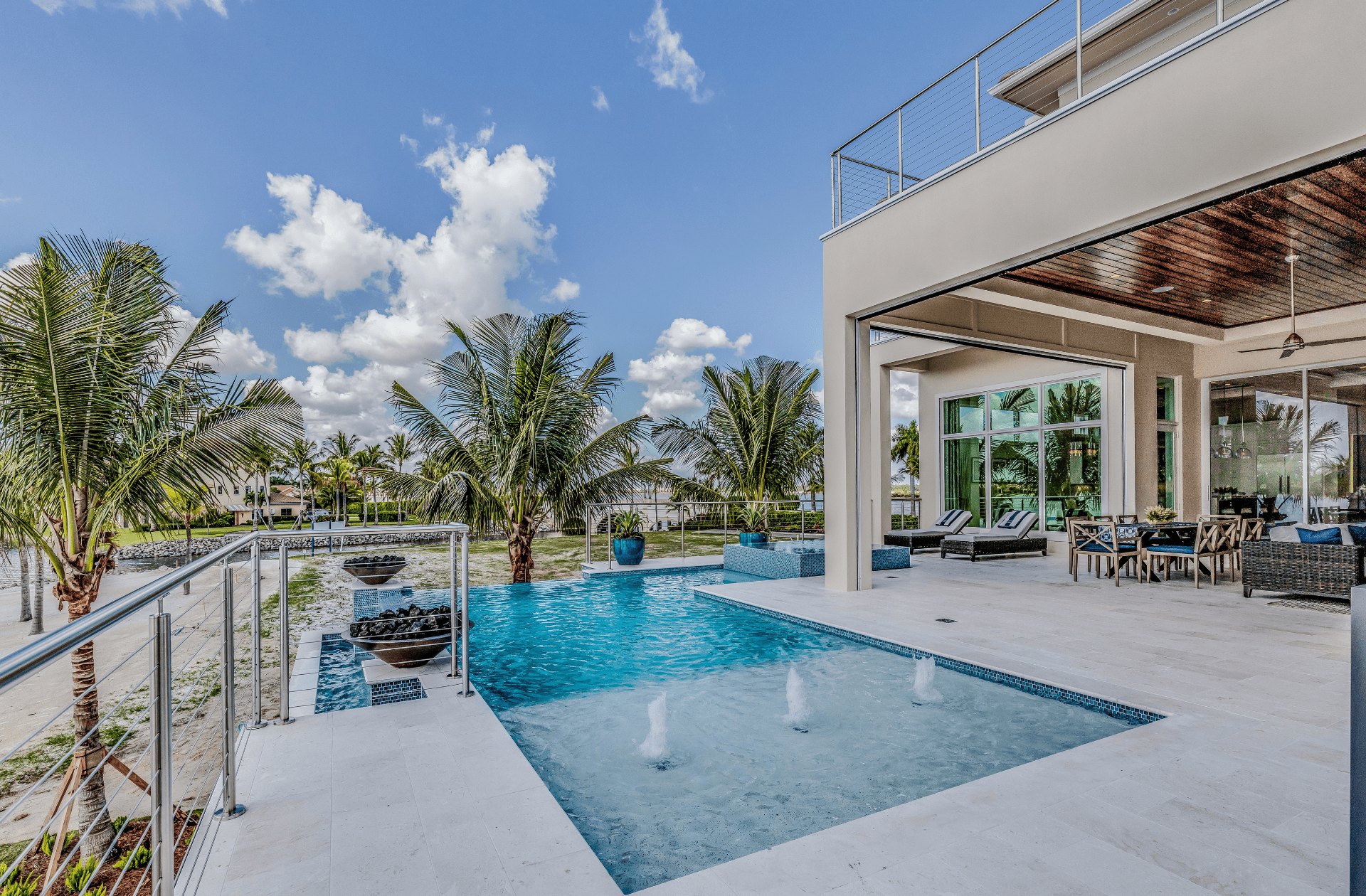

Before embarking on your homebuying journey, it's essential to familiarize yourself with Fort Lauderdale's real estate market. The city offers a wide range of neighborhoods, each with its unique charm and attractions. From the trendy downtown area to the waterfront properties along the Intracoastal Waterway, Fort Lauderdale has something to offer for every homebuyer.

Keep in mind that the real estate market can be dynamic, with fluctuating prices and demand. Staying informed about current trends and market conditions can help you make informed decisions.

Working with a Real Estate Agent:

Navigating the real estate market, especially in a competitive city like Fort Lauderdale, can be challenging. This is where a local real estate agent comes in handy. Working with an experienced agent who knows the area well can streamline the homebuying process and make it less overwhelming.

A real estate agent can also assist you in the pre-approval process by connecting you with reputable lenders and helping you find the best mortgage options that suit your needs.

Pre-Approval and Mortgage Options:

Once you have obtained pre-approval, you can explore different mortgage options to find the one that aligns with your financial goals. Mortgages come in various types, such as fixed-rate mortgages and adjustable-rate mortgages. Understanding the pros and cons of each type can help you make an informed decision.

It's also crucial to pay attention to interest rates and loan terms. A slight difference in interest rates can significantly impact your monthly mortgage payments and overall affordability.

Common Mistakes to Avoid in the Pre-Approval Process:

While getting pre-approved for a home loan can be a game-changer, it's essential to avoid common mistakes that could jeopardize your pre-approval status. One common mistake is applying with multiple lenders simultaneously, as this can negatively affect your credit score.

Additionally, avoid making significant financial changes during the pre-approval process, such as opening new credit lines or taking on new debt. These changes can raise red flags for lenders and hinder your pre-approval.

Conclusion

Getting pre-approved for a home loan is a crucial step in the home-buying process, especially in Fort Lauderdale's competitive real estate market. Pre-approval provides numerous benefits, including stronger negotiating power, budget clarity, and a smoother home-buying experience. By understanding the pre-approval process and working with the right professionals, you can enhance your chances of finding your dream home in Fort Lauderdale.

Frequently Asked Questions:

Q. What does it mean to get pre-approved for a home loan?

A. Pre-approval is a formal evaluation by a lender to determine how much they are willing to lend you based on your financial situation. It involves a thorough review of your financial documents and credit history.

Q. How long does the pre-approval process usually take?

A. The pre-approval process typically takes a few days to a week, depending on the complexity of your financial situation and the lender's processing times.

Q. Is pre-approval necessary for first-time homebuyers?

A. While pre-approval is not mandatory, it is highly recommended for first-time homebuyers. It gives them a clear budget and strengthens their position in a competitive real estate market.

Q. Can pre-approval be done online?

A. Yes, many lenders offer online pre-approval applications. However, some lenders may require additional documentation and verification before providing a pre-approval letter.

Q. Does pre-approval guarantee loan approval?

A. Pre-approval is not a guarantee of loan approval. The final loan approval is subject to the property's appraisal and other underwriting processes. However, pre-approval significantly enhances your chances of getting approved for a home loan.

Posted by Brook Walsh on

Leave A Comment