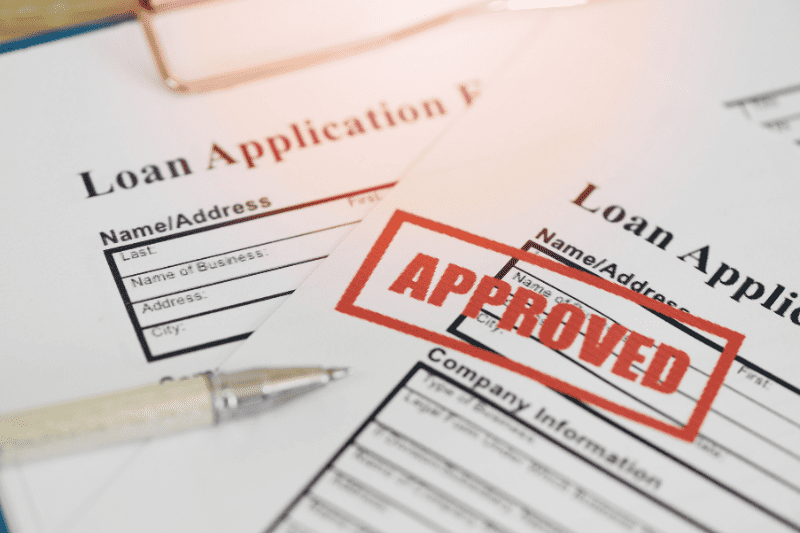

What is a Mortgage?

A mortgage, in simple terms, is a loan you take to buy property or land. It's a legal agreement between you, the borrower, and the lender, usually a bank or financial institution. Sounds simple enough, right? Let's dig a bit deeper.

Importance of Mortgages

Why are mortgages so important? Well, purchasing a house is a major financial decision, and most people can't afford to pay the entire cost upfront. Mortgages offer a solution by allowing you to spread the cost over many years, typically 15 to 30 years.

Understanding Mortgage Options in Fort Lauderdale

Living in sunny Fort Lauderdale and thinking about purchasing a house? You need to understand your mortgage options. Let's dive in.

Fixed-Rate Mortgages

Fixed-rate mortgages come with an interest rate that stays the same for the life of the loan.

Advantages of Fixed-Rate Mortgages

With fixed-rate mortgages, you can plan your budget effectively as your monthly payment will never change. No surprises, no shocks!

Disadvantages of Fixed-Rate Mortgages

The downside? If interest rates fall, you're stuck with the higher rate unless you refinance.

Adjustable-Rate Mortgages (ARMs)

With an adjustable-rate mortgage, the interest rate changes periodically, usually in relation to an index.

Advantages of Adjustable-Rate Mortgages

The initial interest rate for ARMs is usually lower than fixed-rate mortgages. If rates drop, your payment will too!

Disadvantages of Adjustable-Rate Mortgages

The risk with ARMs is if interest rates rise, so will your monthly payment.

FHA Loans

FHA loans are insured by the Federal Housing Administration. These loans are designed for low-to-moderate-income borrowers who can't make a large down payment.

Advantages of FHA Loans

FHA loans require a lower minimum down payment and credit score than many other loans.

Disadvantages of FHA Loans

The downside is that you'll have to pay for mortgage insurance, which will increase the cost of your monthly payments.

VA Loans

VA loans are backed by the Department of Veterans Affairs and are available to active service members, veterans, and their families.

Advantages of VA Loans

The perks? VA loans don't require a down payment or private mortgage insurance.

Disadvantages of VA Loans

The main drawback is that they are only available to a specific group of people, and there might be a cap on how much you can borrow.

How to Choose the Right Mortgage Option

Understanding Your Financial Position

Understanding your financial position is the first step. Evaluate your income, credit score, down payment ability, and how much you can afford to borrow.

Considering Market Conditions

Consider the current market conditions. If interest rates are low, a fixed-rate mortgage might be a good choice.

Conclusion

When it comes to selecting a mortgage in Fort Lauderdale, there's no one-size-fits-all solution. The best choice depends on your personal situation and financial goals. Remember, buying a house is a significant investment, so choose wisely!

Frequently Asked Questions

Q. What are the primary types of mortgages available in Fort Lauderdale?

A. The primary types are fixed-rate mortgages, adjustable-rate mortgages, FHA loans, and VA loans.

Q. What is a good credit score for getting a mortgage in Fort Lauderdale?

A. Most lenders prefer a credit score of 620 or higher for conventional loans. FHA loans might accept scores as low as 580.

Q. Can I get a mortgage in Fort Lauderdale with a low down payment?

A. Yes, some options like FHA and VA loans require low or no down payment.

Q. How do I choose the best mortgage option?

A. Start by understanding your financial position and then compare the different mortgage options. It may also be beneficial to speak with a mortgage broker or financial advisor.

Q. What is the downside of a fixed-rate mortgage?

A. If interest rates fall, you could be stuck with a higher rate unless you refinance.

Leave A Comment