Jupiter, Florida, is one of the hottest real estate markets for investors looking to capitalize on high property values, strong rental demand, and a thriving local economy. Whether you're considering buying rental properties, flipping homes, or investing in commercial real estate, Jupiter has something to offer.

In this guide, we'll break down everything you need to know about real estate investment in Jupiter, FL, including the best neighborhoods, market trends, investment strategies, and potential risks.

Key Takeaways

- Jupiter, FL, is a prime location for real estate investment due to its strong economy, high demand for rentals, and growing population.

- The market is competitive, so investors need to act quickly and make informed decisions.

- Understanding property taxes, rental laws, and financing options is crucial for success.

- The best investment strategies include long-term rentals, vacation properties, and fix-and-flip opportunities.

Why Invest in Real Estate in Jupiter, FL?

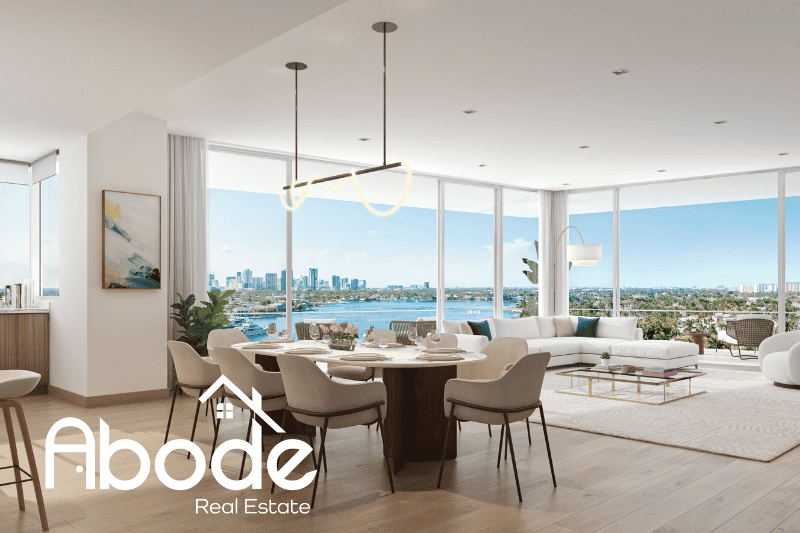

Jupiter offers a unique combination of beautiful beaches, luxury homes, and a booming economy, making it an attractive location for investors.

1. Strong Housing Market

- Median Home Price: $800,000+ (as of 2025)

- Annual Appreciation: 5-7%

- High Demand: Both homeowners and renters are looking to move to Jupiter due to its coastal lifestyle and economic growth.

2. Favorable Economic Conditions

- No state income tax in Florida.

- Low property taxes compared to other high-end locations.

- Growing employment opportunities in finance, healthcare, and tourism.

3. High Rental Demand

- Many people are moving to Jupiter for work or retirement, increasing the need for long-term rentals.

- Vacation rentals are extremely profitable due to Jupiter’s popularity among tourists.

Best Neighborhoods for Real Estate Investment in Jupiter, FL

If you want to maximize your return on investment (ROI), choosing the right neighborhood is crucial.

1. Abacoa

- Type of Investment: Long-term rentals, single-family homes

- Why Invest?: Family-friendly community, excellent schools, and a growing demand for rental properties.

2. Jupiter Inlet Colony

- Type of Investment: Luxury properties, short-term rentals

- Why Invest?: Waterfront properties with high resale value and strong demand for vacation rentals.

3. The Bluffs

- Type of Investment: Condos and townhomes

- Why Invest?: Close to the beach, affordable compared to other waterfront locations.

4. Tequesta

- Type of Investment: Fix-and-flip, commercial real estate

- Why Invest?: More affordable homes with high appreciation potential.

Top Real Estate Investment Strategies in Jupiter, FL

Different investors have different goals. Here are the best strategies for real estate investment in Jupiter, FL.

1. Long-Term Rentals

- Why It Works?: Steady rental income, high occupancy rates.

- Average Rent in Jupiter: $3,000 - $6,000/month.

- Best Areas: Abacoa, The Bluffs.

2. Vacation Rentals (Airbnb/VRBO)

- Why It Works?: Jupiter is a popular tourist destination.

- Best Areas: Jupiter Inlet Colony, waterfront properties.

- Potential ROI: High (but requires property management).

3. Fix-and-Flip Homes

- Why It Works?: Home values in Jupiter are rising quickly.

- Best Areas: Tequesta, older neighborhoods in central Jupiter.

- Challenges: Finding undervalued properties in a competitive market.

4. Commercial Real Estate

- Why It Works?: Jupiter is growing rapidly, and businesses need space.

- Best Areas: Downtown Jupiter, Tequesta.

- Ideal Investments: Retail spaces, office buildings, mixed-use properties.

Challenges & Risks of Real Estate Investment in Jupiter, FL

While Jupiter is a fantastic place to invest, it comes with some challenges.

1. High Competition

- The demand for properties in Jupiter is extremely high.

- Expect bidding wars and above-market pricing.

2. Property Insurance Costs

- Being a coastal city, hurricane risks increase insurance costs.

- Ensure you get proper flood and windstorm coverage.

3. Short-Term Rental Regulations

- Some areas have restrictions on Airbnb and short-term rentals.

- Check local zoning laws before investing.

4. Market Fluctuations

- Florida's real estate market has seen rapid growth, but downturns can happen.

- Diversifying your investments can help reduce risk.

Financing Options for Real Estate Investment in Jupiter

Whether you're a first-time investor or an experienced one, understanding financing options is essential.

1. Conventional Loans

- Ideal for long-term rentals and residential properties.

- Typically require 20% down payment.

2. Hard Money Loans

- Best for fix-and-flip investors.

- Higher interest rates, but quick approval.

3. DSCR Loans (Debt-Service Coverage Ratio)

- Based on the property’s income, not the investor’s income.

- Great for investors looking to build rental portfolios.

4. Private Lending & Partnerships

- Investors can pool resources to purchase higher-value properties.

- Less strict than traditional banks.

FAQs About Real Estate Investment in Jupiter, FL

1. Is Jupiter, FL, a good place to invest in real estate?

Yes! Jupiter offers strong appreciation, high rental demand, and tax benefits for investors.

2. What is the average rental income in Jupiter?

- Long-term rentals: $3,000 - $6,000/month.

- Short-term rentals (Airbnb): $200 - $500/night, depending on location.

3. What are the risks of investing in Jupiter real estate?

- Hurricane risks (high insurance costs).

- Market fluctuations.

- Zoning restrictions on short-term rentals.

4. How much do you need to invest in Jupiter real estate?

- Entry-level homes: $500,000 - $700,000.

- Luxury properties: $1M+.

- Condos & townhomes: $400,000+.

5. What are the best types of properties to invest in?

- Long-term rentals for stable income.

- Vacation rentals for high ROI.

- Fix-and-flip properties in growing neighborhoods.

External Resources for Real Estate Investment in Jupiter, FL

Here are some helpful links for investors:

- Florida Rental Laws and Regulations – Florida Housing Finance Corporation

- Property Tax Information in Palm Beach County – Palm Beach County Tax Collector

Leave A Comment