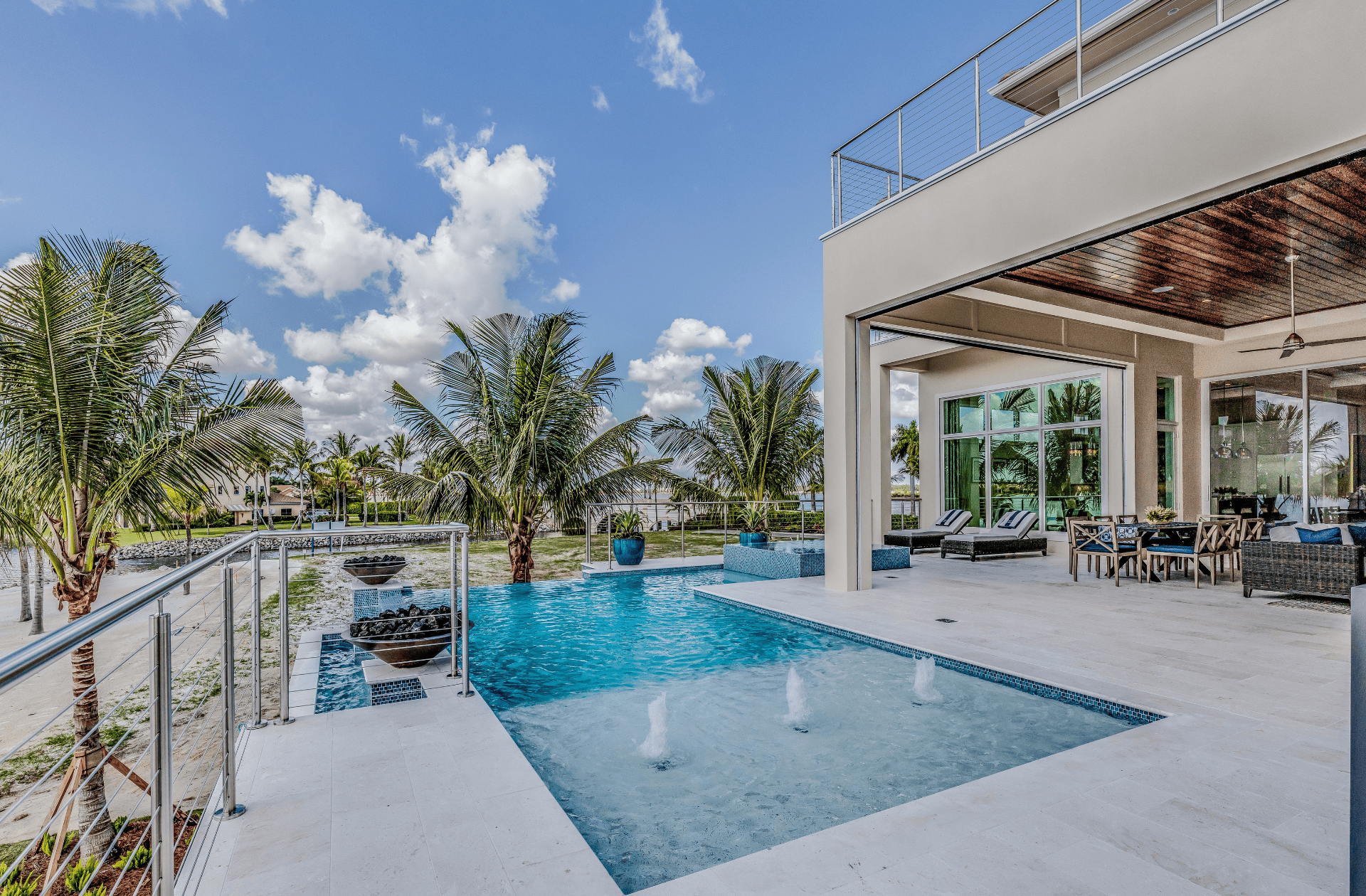

Why Refinance Your Home?

Refinancing your Fort Lauderdale home can bring a multitude of benefits. Whether it's to take advantage of lower interest rates, shorten the term of your loan, or consolidate debt, homeowners have many motivations for considering refinancing.

Benefits of Refinancing

When you refinance, you're essentially taking out a new mortgage to pay off your current one. This might sound counterproductive, but it can lead to significant financial savings, especially if interest rates have dropped since you took out your original loan.

When to Refinance

Refinancing isn't always the best move. You'll need to consider your current financial situation, your credit score, the market conditions, and your long-term plans for the property. If these factors align, it might be the perfect time to refinance.

Understanding the Refinancing Process in Fort Lauderdale

Navigating the refinancing process can seem daunting, especially if it's your first time. Here's a step-by-step guide to help you understand what to expect.

Steps to Refinance Your Home

Evaluate Your Financial Situation

First, you'll need to take a hard look at your finances. How much equity do you have in your home? What's your credit score? These factors will greatly influence the terms of your new loan.

Choose the Right Refinancing Option

There are several types of refinancing options available, each with their own pros and cons. Your choice should align with your financial goals and circumstances.

Closing the Refinance

The closing process involves a final review of your new loan terms, signing documents, and paying closing costs.

Costs Involved in Refinancing

Don't forget about the costs involved in refinancing. These might include appraisal fees, origination fees, and closing costs. Always factor these into your decision-making process.

Selecting the Right Lender in Fort Lauderdale

Choosing the right lender is crucial in your refinancing journey. The right lender will offer competitive rates, transparent terms, and excellent customer service.

Things to Consider When Choosing a Lender

Consider their reputation, customer reviews, loan terms, and responsiveness. Each of these factors can significantly impact your refinancing experience.

Long-Term Implications of Refinancing

It's important to remember that refinancing comes with long-term implications. Your monthly payments may decrease, but the total amount paid over the life of the loan may increase.

Possible Risks and How to Mitigate Them

Refinancing can be a powerful financial tool when used correctly, but it also comes with risks. Understanding these risks and how to mitigate them will help you make informed decisions.

Conclusion

Refinancing your home in Fort Lauderdale is a significant financial decision, but it can be an excellent strategy if done correctly. Consider your personal financial situation, market conditions, and long-term goals before making the leap.

Frequently Asked Questions

The worth of refinancing a home depends on several factors including the interest rate of your current mortgage, the rate you can secure with a refinance, the costs associated with refinancing, and your long-term financial goals. If the overall savings over the life of the loan surpasses the cost of refinancing, then it can be worth it.

Q. How does refinancing work?

A. Refinancing involves replacing your current mortgage with a new one. This new loan typically has more favorable terms like lower interest rates or a shorter loan term. The process involves checking your credit score, evaluating your financial situation, researching suitable lenders, applying for the new mortgage, and going through the closing process again.

Q. What are the costs involved in refinancing?

A. Refinancing isn't free. There are several costs to consider, including but not limited to application fees, loan origination fees, appraisal fees, title search and insurance, closing costs, and possibly a penalty for paying off your old mortgage early. These costs can amount to 2-6% of the loan's principal.

Q. How do I choose the right lender for refinancing?

A. To choose the right lender, first do your research. Look at the loan terms they offer, their interest rates, and any fees they charge. Read reviews to learn about other customers' experiences. Finally, consider their customer service – good communication can make the process much smoother.

Q. What are the long-term implications of refinancing?

A. Refinancing can reduce your monthly payments and/or the overall interest you pay, but it can also extend the time it takes to pay off your home. You'll also have to consider the costs of refinancing, which could take several years to recoup. It's important to consider these factors and how they align with your long-term financial goals before deciding to refinance.

Leave A Comment